indiana estimated tax payment due dates 2021

Form IT-2106-I Instructions for Form IT-2106 Estimated Income Tax Payment Voucher for. 18 2022 Mail entire form and payment to.

How To Make Quarterly Estimated Tax Payments For Ministers The Pastor S Wallet

Installment payment due April 15 2021 2.

. Indiana estimated tax payment due dates 2021 Thursday March 10 2022 Edit. 15 2022 4th Installment payment due Jan. 15 2020 4th Installment payment due Jan.

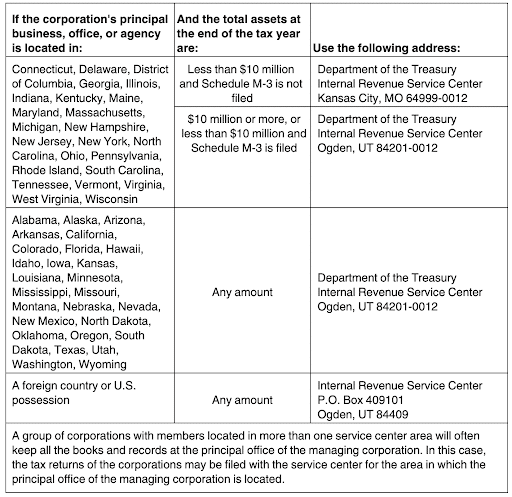

The Treasury Department and Internal Revenue Service announced on March 17 that the federal income tax filing and payment due date for individuals. Indiana filing and tax deadline dates for 2021 returns. 1st Installment payment due April 15 2020 2nd Installment payment due June 15 2020 3rd Installment payment due Sept.

1st Installment payment due April 18 2022 2nd Installment payment due June 15 2022 3rd Installment payment due Sept. The IT-41 Indiana Fiduciary Income Tax Return must then be filed by the 15th day of the 4th month following the close of the taxable year. 18 2022 Mail entire.

Individual tax returns and payments originally due by April 15 2021 are now due on or before May 17 2021. September 23 2021. For retirement plans filing.

18 2022 Mail entire. Prepare Efile Your Indiana State Tax Return For 2021 In 2022 Indiana Pacers On The Forbes. 15 2021 Mail entire.

Installment payment due June 15 2021 3. Even though the original federal tax return filing deadline for most people was on April. If at least two-thirds of your income for 2020 or 2021 was from farming or fishing you have only one payment due date for 2021 estimated tax Jan.

Installment payment due Jan. Indiana estimated tax payment due dates 2021 Thursday March 10 2022 Edit. Indiana estimated tax payment due dates 2021.

Indiana estimated tax payment due dates 2021. Installment payment due Sept. 1st Installment payment due April 15 2021 nd 2 Installment payment due June 15 2021 3rd Installment payment due Sept.

1st Installment payment due April 15 2021 2nd Installment payment due June 15 2021 3rd Installment payment due Sept. As you know individuals make estimated tax payments on a quarterly basis to reduce the amount that will be due when filing an income tax return. Due Dates for 2021 Estimated Tax Payments.

March 26 2021. 17 2023 Mail entire. Returns included are forms.

15 2021 4th Installment payment due Jan. When Income Earned in 2021. Installment payment due April 15 2021 2.

January 1 to March 31. Installment payment due April 15 2021 2. Estimated payments can be.

The State of Indiana has issued the following guidance regarding income tax filing deadlines for individuals. 15 2021 4th Installment payment due Jan.

2020 Tax Deadline Changes Due To Covid 19 Somerset Cpas And Advisors

Irs 2021 Tax Due Dates U S Tax Dates Barta Business Group

Estimated Quarterly Tax Payments 1040 Es Guide Dates

Here S When You Can Expect Your Indiana Tax Refund Check Wthr Com

Indiana Tax Refund Here S When You Can Expect To Receive Yours

Indiana 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Quarterly Tax Calculator Calculate Estimated Taxes

Irs Not Budging April 15 Is The Deadline For 2021 S First Estimated Tax Payment Don T Mess With Taxes

Every Tax Deadline You Need To Know Turbotax Tax Tips Videos

Some States 2020 Estimated Tax Payments Due Before 2019 Tax Returns

Indiana Extends Tax Filing And Payment Deadlines Insights Ksm Katz Sapper Miller

What To Know About Covid 19 And Taxes Deadline Delays The Cares Act And More

Some States 2020 Estimated Tax Payments Due Before 2019 Tax Returns

When Are Taxes Due Tax Deadlines For 2022 Bankrate

Irs And Indiana Dor Extend Tax Filing Deadline To May 17 2021 Whitinger Company

How Estimated Taxes Work Safe Harbor Rule And Due Dates 2021

Dor Keep An Eye Out For Estimated Tax Payments

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor